Debt Traps 101: What They Are And How To Climb Out

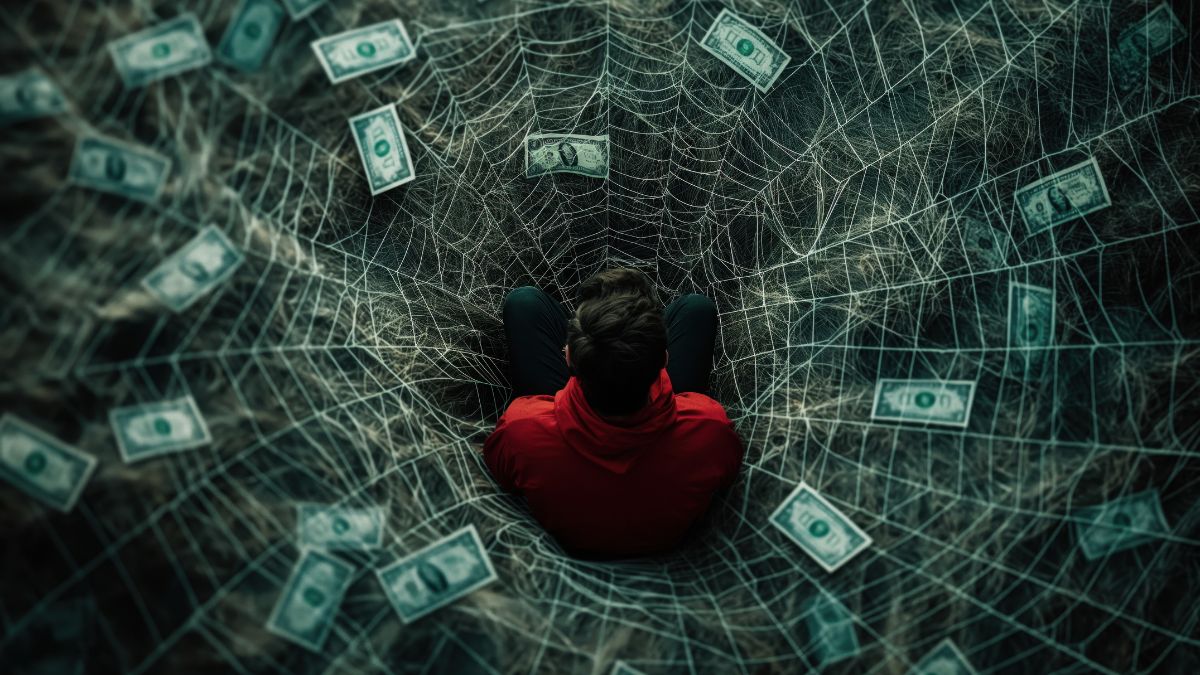

Ever feel like your monthly payments are chasing you down faster than your salary can catch up? That’s the classic sign of a debt trap—a financial quicksand that pulls you deeper the more you struggle. But don’t worry, you’re not alone, and more importantly, you’re not stuck forever.

What Exactly Is a Debt Trap?

A debt trap happens when you borrow money to repay existing loans, and then borrow again to cover the new ones. Soon, your monthly income is barely enough to cover interest payments, let alone the principal. It’s a dangerous cycle where the more you borrow, the harder it gets to escape. Personal loans, credit card debt, and quick financing schemes—especially those with high interest rates—are the usual culprits that end up landing individuals in a debt trap.

How Do People End Up Here?

Let’s face it: not all debt is bad. Loans taken for education, housing, or to start a business can be productive. But problems arise when credit cards are maxed out regularly, EMIs eat up over 50 per cent of your monthly income, or borrowing becomes a habit, not a solution.

According to the Reserve Bank of India, India’s household debt-to-GDP ratio rose to 81.59 per cent in 2023, indicating rising financial stress among middle-class families. This often stems from lifestyle inflation, job uncertainty, medical emergencies, or speculative trading losses.

Also Read : What Is A Nil ITR And Should You File One?

Step One: Face the Numbers

The first rule of escaping a debt trap? Stop ignoring your finances. Create a detailed list of all outstanding debts, interest rates and monthly outflows, and loan tenures and any penalties. You’d be surprised how empowering it feels just to know the real picture.

Step Two: Prioritise and Strategise

There are two popular repayment methods:

Avalanche Method: Pay off the highest interest loan first (often credit cards), then move to lower-interest ones.

Snowball Method: Start with the smallest loan to gain quick wins, then tackle the bigger ones.

Personal finance experts suggest choosing based on your mindset—if motivation is your driver, the snowball method works best. If saving money on interest is your goal, go avalanche.

Step Three: Refinance or Consolidate

One smart move is to consolidate multiple debts into a single lower-interest loan, like a secured personal loan or a top-up on your home loan. This can help reduce EMI burden and simplify repayments, especially for salaried individuals.

You can also approach your lender to restructure your EMIs or extend the repayment tenure.

Also Read : 8th Pay Commission: Who Benefits And When Will Hikes Be Implemented?

Step Four: Cut the Leak

It’s time for a budget detox. Track every rupee. Apps or a simple spreadsheet will do. Eliminate impulse buys, expensive subscriptions, and non-essential spending.

Instead, channel that saved money towards your repayments. Building an emergency fund (worth 3–6 months of expenses) is also key to prevent future borrowing.

Step Five: Increase Income, Not Just Guilt

Paying off debt faster isn’t only about cutting costs—it’s about boosting earnings too. Freelance gigs, selling unused assets, tutoring, or part-time consulting can all bring in extra income streams. Every extra rupee helps shrink your debt timeline.

When to Seek Help

If your debt is unmanageable despite your best efforts, it might be time to talk to a professional. Debt counsellors or financial planners can help negotiate with lenders, restructure your loans, or offer legal options if needed.

Many borrowers have successfully exited severe debt situations with expert guidance, so don’t hesitate to ask for help.

From Trap to Triumph

A debt trap might seem like a never-ending tunnel, but there is light at the end. With planning, self-discipline, and a few smart moves, you can regain control of your money and your peace of mind.

Remember, getting into debt isn’t a failure—it’s a financial phase. What matters is how you handle it from here on.

business