New Circular: UPI rules will change from August 31, NPCI issued new circular

NPCI has issued new guidelines regarding pre-approved credit line. All banks and financial institutions will have to follow this. Time till 31 August has also been given for this. Let’s take a look at these changes-

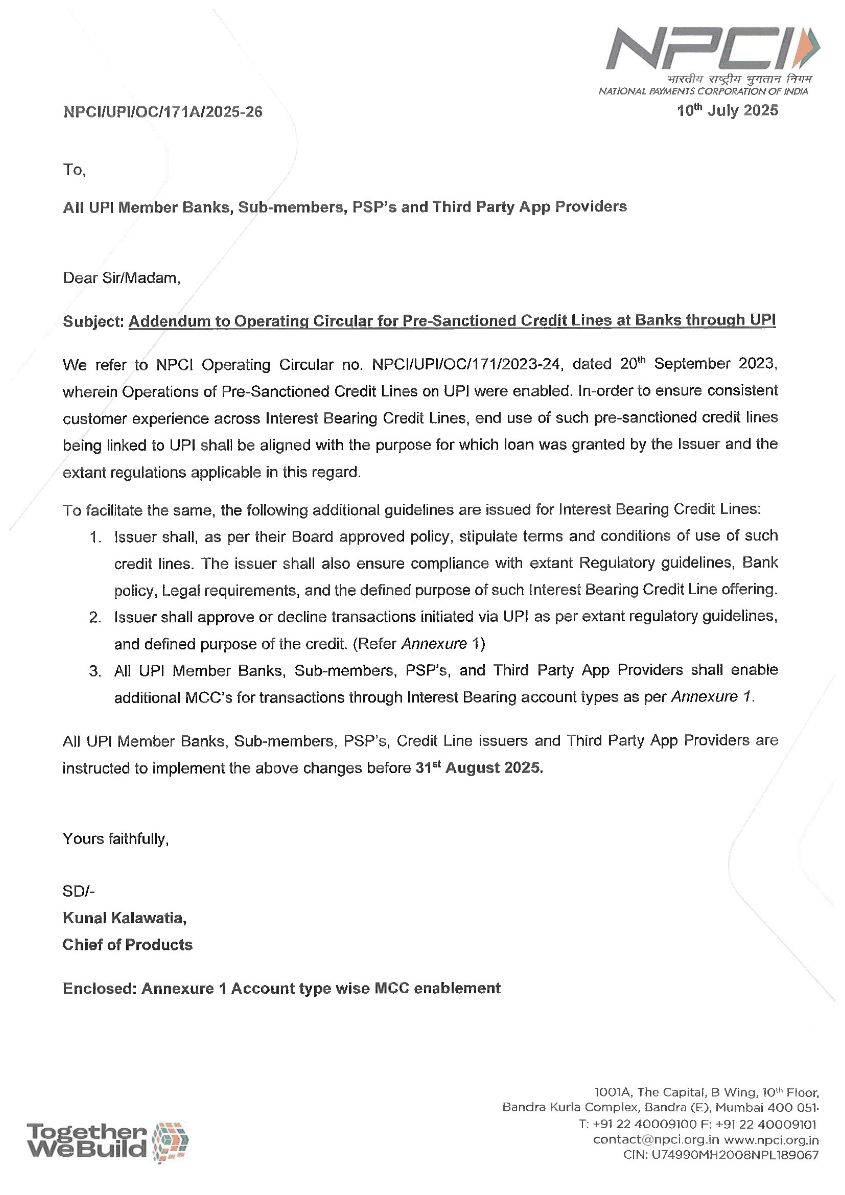

NPCI new guidelines: The National Payments Corporation of India has made many changes in the Unified Payment Interface (UPI) in the last few months. New rules are going to be implemented once again. Which will also affect the users. A circular has been issued related to pre-approved credit lines. Some important instructions have also been given to banks, sub-members, PSPs, credit line issuers and third party app providers. Time has been given till 31 August to implement these changes.

Let us tell you that under a circular issued in September 2023, the facility of pre-approved credit lines was started on UPI. Some rules were also laid down to provide a uniform experience to the customers in interest bearing credit lines. Along with the existing rules, some extra guidelines will now have to be followed by the issuing bank or financial institution for interest bearing credit lines.

NPCI’s new guidelines (UPI Rules)

- Issuers will determine the terms of use of these credit lines under their board-approved policy. Apart from this, compliance with existing regulatory guidelines, bank policy and legal requirements and the defined purpose of the interest-bearing credit line offer will also have to be ensured.

- The issuer will approve or reject transactions initiated through UPI as per the existing regulatory guidelines and the defined purpose of the credit.

- All UPI member banks, PSPs and third party apps have also been directed to enable additional MCC for transactions through interest-bearing account types.

What is a pre-approved credit line? (Pre-Sanctioned Credit Lines)

Pre-approved credit line is a special facility through which banks or financial institutions allow a customer a pre-determined credit limit. Customers can borrow through an easy process without applying. That means if a customer’s credit line limit is Rs 1 lakh, then he can make payment by scanning the QR code or through UPI ID. The special thing is that till a user does not withdraw the money, no interest is charged on it.

News