US Tariffs Spark Global Ripples: Here's How Currencies Of Major Economies Are Reacting

The tariffs imposed by US President Donald Trump have come into effect, targeting imports from more than 90 countries. Under the new measures, companies importing foreign goods into the US will now be required to pay significantly higher taxes, which experts warn may ultimately be passed on to consumers. Brazil and India are among the hardest hit, each facing a steep 50 per cent tariff on most goods. India’s new rates will take effect from August 27. Canada is already under a 35 per cent tariff regime, although many goods remain exempt under the US-Mexico-Canada Agreement (USMCA).

Trump had previously warned India of an additional 25 per cent tariff as a penalty for continuing to import Russian oil amid the Ukraine conflict. “We’re being very clear — if you buy from Russia, you’ll face consequences,” he stated during a press briefing earlier this week.

While some countries are seeking to avoid further penalties, negotiations remain ongoing. The US and China have agreed to delay any additional tariffs until August 12 as part of continued trade talks. Mexico has also secured a temporary reprieve, with Trump announcing that current tariff rates will remain unchanged for another 90 days—postponing a planned increase to 35 per cent. The escalating trade restrictions come as part of Trump’s broader "America First" strategy, aimed at reshaping global trade dynamics and reducing US dependence on foreign imports.

Effect On Currencies Of The World’s Superpowers

The newly imposed US tariffs have so far had a limited immediate impact on the currencies of major trading partners like the UK, Canada, Brazil, Russia, and China, among others. While there have been minor fluctuations, most currencies have remained relatively stable in the short term. However, analysts caution that increased trade tensions could lead to heightened volatility in the coming weeks, especially if negotiations stall or tariffs expand further. Markets are closely watching how these countries respond, as prolonged uncertainty may eventually influence currency movements and investor sentiment.

Canada (USD To CAD)

Although Canada has been facing a 35 per cent tariff since last week, the Canadian dollar has held up fairly well, with the USD declining just 1.01 per cent over the past week, according to Xe. This relatively muted currency reaction suggests that markets had already priced in trade risks or that exemptions under the USMCA are cushioning the blow. Nonetheless, the potential for broader tariff impacts remains a concern for Canadian exporters and currency traders alike.

United Kingdom (USD To GBP)

Over the short term, the US dollar has declined by 1.85 per cent against the British pound, signaling a mild yet steady weakening trend. This comes as the United States enforces a 10 per cent tariff on goods imported from the United Kingdom.

China (USD To CNY)

Despite the US and China agreeing to delay additional tariffs until August 12, the yuan has slipped slightly, with the USD down 0.39 per cent over the week. This mild decline points to underlying trade tensions still influencing currency expectations. The yuan’s relative stability suggests that markets are awaiting concrete outcomes from ongoing negotiations before reacting strongly.

Russia (USD To RUB)

The Russian ruble has experienced a modest gain, with the USD losing 0.85 per cent in value over the week. While Russia was not highlighted in the top tier of tariff-affected countries, broader geopolitical risks and the specter of future sanctions or trade barriers may be feeding into cautious dollar selling.

Brazil (USD To BRL)

Brazil, one of the countries hit with the highest US tariff rate of 50 per cent, has seen a notable 3.13 per cent strengthening of its currency against the dollar. This move could reflect confidence in Brazil’s ability to manage the tariff impact or short-term capital inflows seeking emerging market returns. However, the real gains may face headwinds if tariffs persist and begin to weigh on Brazil’s export-driven sectors.

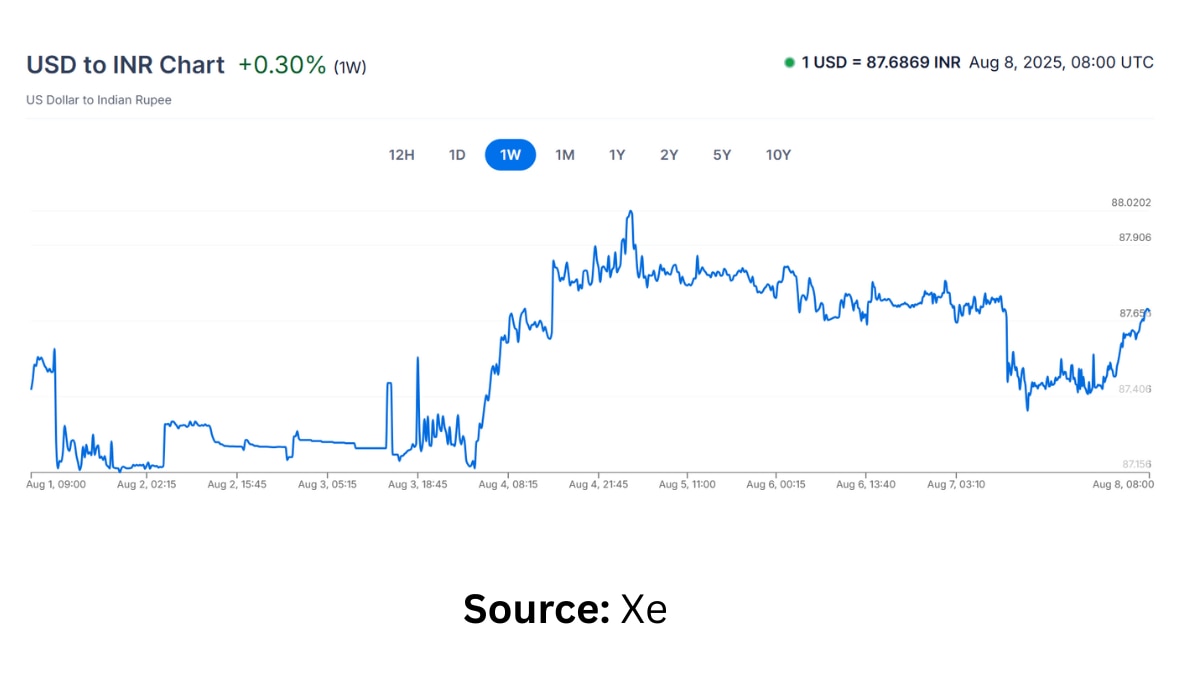

India (USD To Rupee)

India’s rupee has shown mild depreciation this week, with the USD gaining 0.30 per cent against it, amid rising concerns over new US tariff measures. As India now shares the top spot with Brazil on the global tariff chart following a fresh hike by the United States. Under President Donald Trump’s directive, an additional 25 per cent import duty has been imposed on Indian goods, raising the total tariff burden to 50 per cent.

Meanwhile, even though the INR hasn't shown extreme volatility, the uncertainty stemming from a shifting global trade environment has led to mild downward pressure. Investors are showing caution, pricing in possible future spillovers if India’s export sectors—such as IT, pharmaceuticals, or auto components—get impacted by secondary effects of global supply chain disruptions.

business