Shapoorji Mistry reiterates demand for Tata Sons listing; Tata Trusts meeting avoids contentious issues

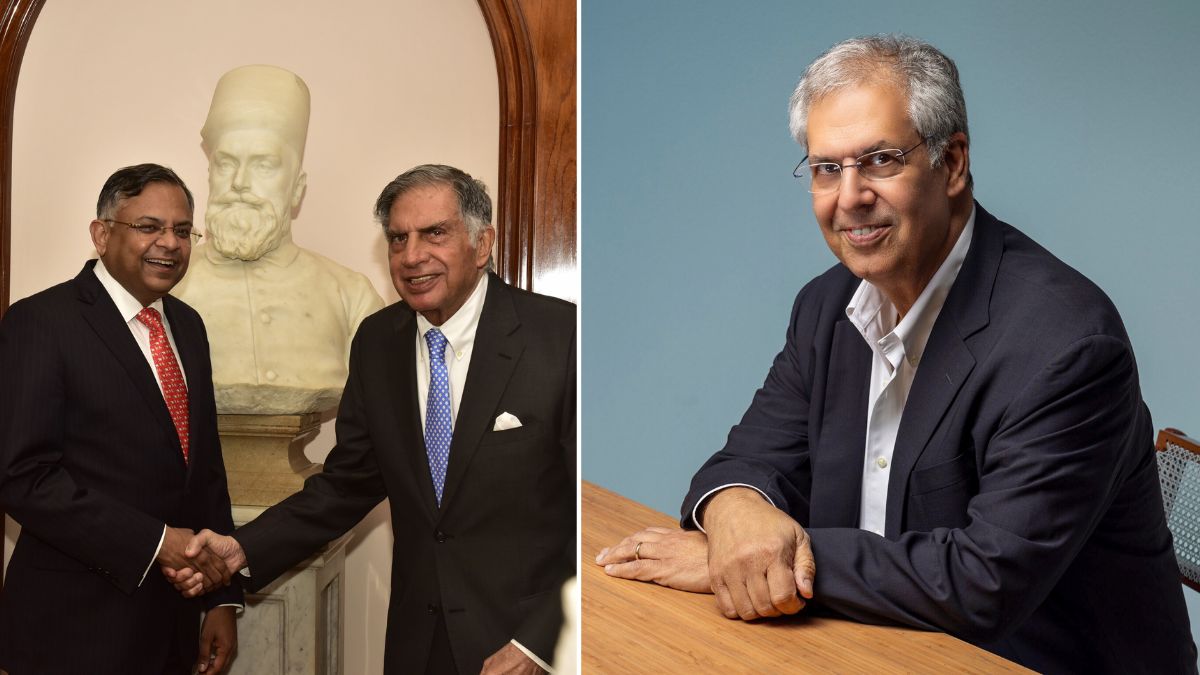

N. Chandrasekaran is the chairman of Tata Sons since 2017 while Noel Tata succeeded late Ratan Tata as chairman of Tata Trusts | X, PTI

N. Chandrasekaran is the chairman of Tata Sons since 2017 while Noel Tata succeeded late Ratan Tata as chairman of Tata Trusts | X, PTI

At a time differences seem to have emerged among the members of the Tata Trusts over board appointments at Tata Sons as well as the overhang of its potential listing, the Shapoorji Pallonji Group has reiterated its long-standing position that the holding company of the Tata Group should go public. This, the industrialist Shapoorji Pallonji Mistry said, was rooted in transparency, fairness, public interest and in adherence to good corporate governance.

The SP Group has been among the oldest shareholders in Tata Sons, with a stake of around 18.37 per cent. The relations between the two groups has spanned generations and had been cordial. But things changed after Cyrus Mistry, the younger son of SP Group patriarch Pallonji Mistry, was unceremoniously sacked as chairman of Tata Sons in 2016. Cyrus later died in a car crash in 2022.

The SP Group has been looking to sell its stake in Tata Sons for some time now, as it requires funds, but hasn’t been able to do so. A public listing of Tata Sons will open that road.

“The Shapoorji Pallonji Group has consistently advocated the public listing of Tata Sons. We firmly believe that listing this premier institution will not only uphold the spirit of transparency envisioned by its founding father Jamsetji Tata, but also strengthen trust among all stakeholders – employees, investors and the people of India,” said Shapoorji Mistry.

Mistry’s reiteration of this demand comes at a time when differences have emerged among various trustees of the Tata Trusts. The trusts hold 66 per cent stake in Tata Sons, which given the charitable trusts a wide influence in terms of strategy and appointments. Noel Tata leads the Tata Trusts.

The differences within the trustees are learnt to have been over board appointments, after a few trustees refused the appointment of trustee Vijay Singh to the Tata Sons board.

Tata vs Mistry

The rift had divided the group between the trustees close to Noel Tata and those led by Mehli Mistry in the Tata Trusts. Mistry is the first cousin of the late Cyrus Mistry, The other key board trustees include Venu Srinivasan (chairman emeritus of TVS Motor Co and vice-chairman of Tata Trusts), Darius Khambata (senior lawyer), Jehangir HC Jehangir (philanthropist) and Pramit Jhaveri (banker and former Citi India CEO).

Earlier this week, representatives of Tata Sons and Tata Trusts, including Noel Tata and N. Chandrasekaran, the chairman of Tata Sons, met Union Ministers Amit Shah and Nirmala Sitharaman. Reports indicated the government has taken a note of the tensions within the board and urged the trustees to amicably resolve the differences.

The trustees met on Friday and the meeting is understood to have been cordial, with none of the contentious issues likely discussed in the meeting.

There has been no official comment from Tata Trusts on the meeting or the issues at hand.

Apart from the differences on board appointments, that public listing of Tata Sons, which Mistry has reiterated, remains a key issue.

Reserve Bank of India’s regulations mandate all upper tier non-banking finance companies list within three years. Tata Sons, which is a core investment company, was one of the 15 entities that RBI had classified as upper tier. That deadline to list passed on September 30.

Tata Sons has made representations to the RBI on the need to remain privately held. But there has been no clarity yet. The belief is that a listing could open the doors for outside investors to enter the fold and perhaps even risk potential takeovers.

Shriram Subramanian, founder and MD of InGovern Research Services, a proxy advisory firm, felt the influence of Tata Trusts would have reduced in case of a listing. He doesn’t feel anyone, barring perhaps the SP Group, is interested the listing.

Ball in RBI's court

The ball in this matter is essentially in the RBI’s court. When asked by reporters earlier this month after the monetary policy committee meeting, RBI Governor Sanjay Malhotra refused to comment on any specific entity, but stressed that any entity, which had a registration till it was not cancelled would continue to do its business.

Mistry expressed confidence on Friday that the RBI would act in accordance with the rule of law and spirit of fairness. He said the listing would unlock immense value for over 1.2 crore shareholders of listed Tata companies, who were indirect shareholders of Tata Sons.

“Importantly, Tata Trusts, India’s largest public charity, stands to benefit immensely from this process. A transparent and publicly accountable Tata Sons would pave the way for a robust and equitable dividend policy, thereby ensuring sustained inflows to the trusts,” said Mistry.

He added that their position was not in conflict, and they wanted to play a constructive role in shaping a future that upheld the legacy of both founding families.

A source indicated earlier that the Tatas have likely convinced the RBI on staying private and that overhang was likely to go by the end of the year.

Experts have pointed that thus far it is unlikely that the differences between the trustees will have any impact on Tata Sons or the listed and unlisted entities of the group.

“I don’t see any impact on Tata Sons as an entity. Of course, if matters escalate at Tata Trusts, and things start influencing strategic decisions, we will have to see. But, that doesn’t seem to be the case. For now, there is no impact on the operating 26 listed and the other unlisted companies,” said Subramanian of InGovern.

Business