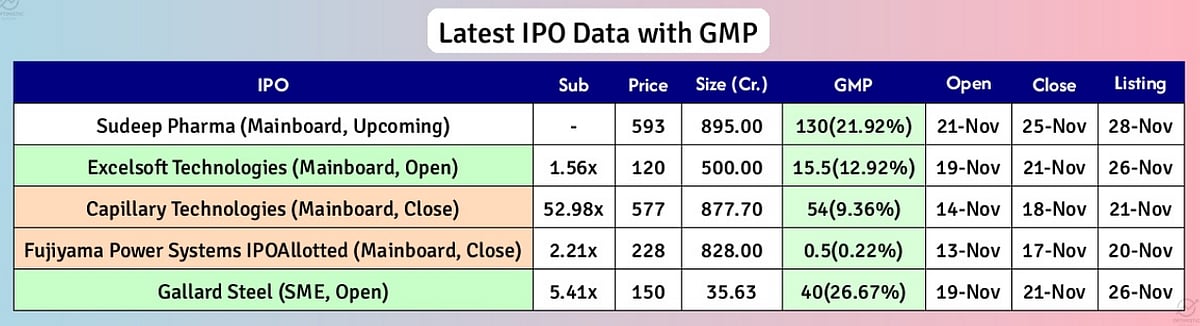

Excelsoft Technologies' ₹500-Crore IPO Receives 1.45 Times Subscription On The First Day Of Bidding

New Delhi: The initial public offer of Excelsoft Technologies Ltd received 1.45 times subscription on the first day of bidding on Wednesday.The three-day IPO got bids for 4,45,38,250 shares against 3,07,01,754 shares on offer, as per NSE data.

Press Release

Press ReleaseThe category for non-institutional investors fetched 2.45 times subscription while the quota for Retail Individual Investors (RIIs) got subscribed 1.85 times. The portion meant for Qualified Institutional Buyers (QIBs) received 1 per cent subscription.

File Image

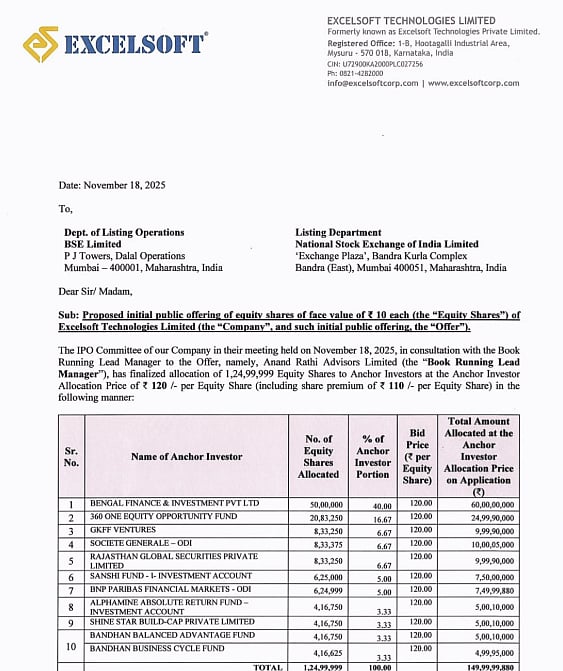

File ImageExcelsoft Technologies, a vertical SaaS (software-as-a-service) company focused on the learning and assessment market, on Tuesday said it has garnered Rs 150 crore from anchor investors.The Rs 500-crore IPO will conclude on November 21. The price band has been fixed at Rs 114-120 per share, valuing the company at around Rs 1,380 crore at the upper end.

The Initial Public Offer (IPO) has a fresh issue aggregating up to Rs 180 crore and an Offer for Sale aggregating up to Rs 320 crore.The company proposes to utilise 61.76 crore from the fresh issue for the purchase of land and construction of a new building at the Mysore Property; Rs 39.51 crore for upgradation and external electrical systems of its existing facility at Mysore; Rs 54.63 crore for funding upgradation of the company's IT Infrastructure and the balance towards general corporate purposes.

With over two decades of experience, Excelsoft provides technology-based solutions across diverse learning and assessment segments through long-term contracts with enterprise clients worldwide.Some of its prominent clients are Pearson Education, Inc., AQA Education, Colleges of Excellence, NxGen Asia PTE LTD, Pearson Professional Assessments Ltd, Sedtech for Technology Education & Learning WLL, Ascend Learning LLC, Brigham Young University--IDAHO, Training Qualifications UK, Surala Net Co Ltd, Excel Public School and The Chartered Quality Institute.

Disclaimer: This story is from the syndicated feed. Nothing has changed except the headline.

news