More than 60 per cent of India’s economy is consumer-led, reveals industry report

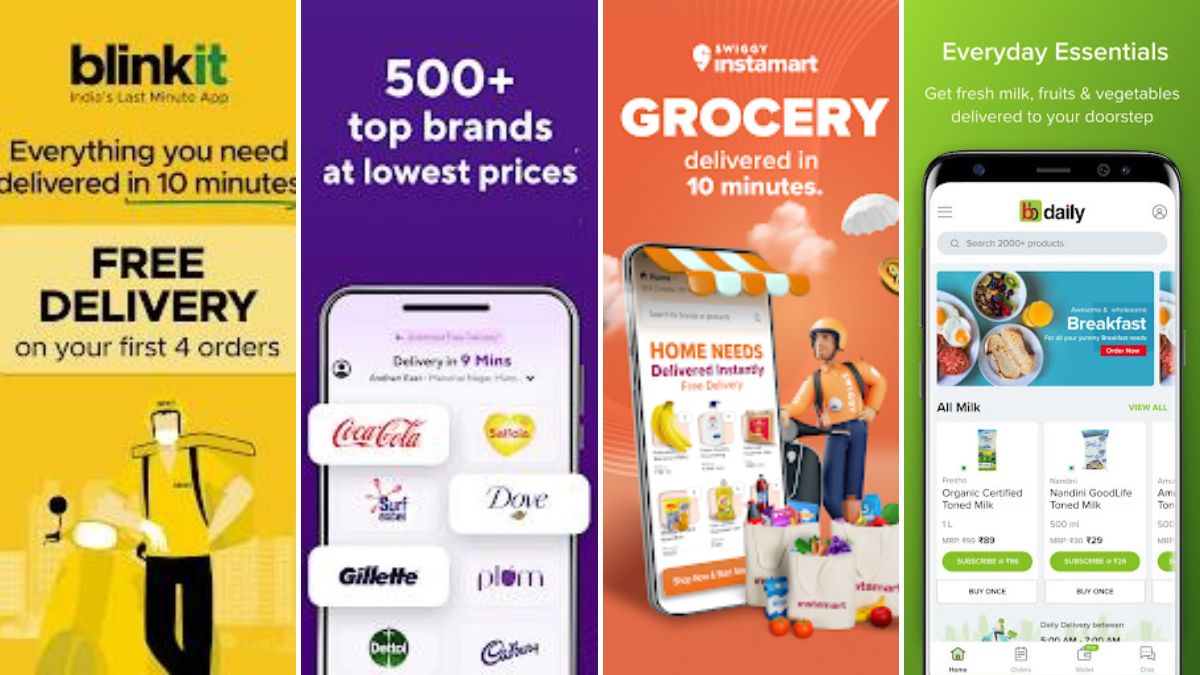

Zomato-owned Blinkit, Zepto, Swiggy Instamart and Big Basket's BB Now are currently the biggest players in Indian quick commerce

Zomato-owned Blinkit, Zepto, Swiggy Instamart and Big Basket's BB Now are currently the biggest players in Indian quick commerce

More than 60 per cent of India’s economy is consumer-led, and a large share of this value is expected to go to consumer startups. The country’s digital economy will do well with a triple engine of commerce, content, and consumer discernment fueled by AI.

India is poised for a new era of consumer innovation, and over the last decade, several technology disruptions have led to an almost $200 billion digital economy on the back of smartphones, e-commerce, UPI, and a rising disposable income, including companies such as Swiggy, Flipkart, and UrbanCompany. The coming decade is poised for an even bigger growth spurt, leading to a trillion-dollar digital opportunity. This era of entrepreneurship is almost five times the value creation that happened in the last decade. These observations were part of a report titled ‘Click, Watch, Shop: The Consumer Opportunity in India’ by Bessemer Venture Partners, focusing on Consumer Trends in India.

The report observed that India’s trillion-dollar digital economy opportunity has been driven by three key elements, including affordable mobile data (around $0.15 per GB) that has enabled widespread internet access for over 800 million Indians, increasing online shoppers from almost none in 2010 to 238 million in 2024. This makes India the second-largest e-commerce market by users, behind China, with projections reaching half a billion by 2030.

The report finds that India’s demographic shifts are significant. As the world’s most populous nation in 2023 (1.48 billion) with a young median age (28.8 years), its per capita discretionary income has doubled to roughly $2,500 in 2024 and is expected to hit $4,000 by 2030, fueling retail growth. It is also interesting to note that a large proportion of India’s young consumer base was born with a smartphone in their hand, with no knowledge of the offline world.

Besides that, policy reforms and a strong digital public infrastructure (DPI) built over the last decade (e.g., the goods and services tax and the Aadhaar identification system) have facilitated smooth online transactions. The report observes that the Unified Payments Interface (UPI) has been particularly impactful, making peer-to-peer and merchant transactions almost seamless.

UPI transaction volumes have exploded from 93,000 in August 2016 to 18.3 billion in March 2025. The report further observes that the next wave of DPI will see the growth of platforms like the open network for digital commerce (ONDC), which is expected to democratise e-commerce, and the open credit enablement network (OCEN), which is expected to do the same for lending.

The report also finds that India’s burgeoning online commerce sector has witnessed an extraordinary expansion in recent years, demonstrating it is no longer a niche phenomenon catering to a small segment. It has firmly established itself as a dominant force within the Indian retail landscape for a significant and growing share of the population. This growth has occurred across a diverse set of product categories, ranging from electronics and fashion to groceries and household goods. Starting from a base of $30 billion in 2020, the market has more than quadrupled, reaching $123 billion in 2024, and is expected to get to $300 billion by 2030.

The report also highlights that the recent rise of quick commerce (or q-commerce, ultra-fast e-commerce) has introduced a new dimension to the online retail ecosystem, further revolutionising the way consumers access goods. Platforms such as BigBasket, Blinkit, Swiggy Instamart, and Zepto have spearheaded this movement, demonstrating the viability and consumer appeal of rapid delivery services. Similarly, e-commerce giants like Amazon and Flipkart are now actively adapting their strategies and infrastructure to participate in and capitalise on the burgeoning q-commerce market in the country. This competitive landscape is driving innovation in logistics, warehousing, and delivery mechanisms, ultimately benefiting consumers with more choices and faster service.

The report also says that the current environment presents an unprecedented opportunity for establishing and scaling a direct-to-consumer (D2C) brand in India, benefiting from both the dynamic online marketplace and the evolving interest of traditional offline channels.

This democratisation of distribution has been accompanied by a marked change in consumer preferences with a demand for newer, better-priced, more aspirational, and higher-quality products. Entrepreneurs have grabbed this opportunity with a proliferation of brands across virtually every category. Be it Boldfit or Blissclub in sports and fitness, Mokobara or Uppercase in travel, Snitch or NEWME in fast fashion, Lifelong or Nuuk in appliances, Minimalist, Innovist, or Deconstruct in beauty, Nestasia or Indus Valley in home and living, Comet, Neeman’s or Yoho in footwear etc.

The report highlights that today, the Indian consumer has an aspirational, mass premium brand to choose from in virtually every category. Besides, as per the report, India is experiencing a content revolution driven by consumers’ diverse appetites for entertainment, education, and gaming. Characterised by short attention spans and a multitude of accessible platforms across interests, languages, and budgets, user engagement is rapid, facilitated by frictionless microtransactions or subscriptions on autopay.

Platforms are adapting to these shorter attention spans with quick and engaging content. Over the past five years, short-form video platforms in India have witnessed 3.6X growth in daily active users, competing with mainstream digital platforms. Projections indicate the online video subscription market in India is anticipated to grow from $700 million in 2020 to $3 billion by 2026.

Business