ITR Refund Status: Income Tax itself told how to check ITR Refund Status, here is the step-by-step process

ITR Refund Status: This time many changes have been made in all the ITR forms by the Income Tax Department. For this reason, the last date for ITR Filing has been extended from 31 July to 15 September. Meanwhile, many people have filed their ITR and are now waiting for their refund (ITR Refund). Now people want to know when the refund will come? Let us tell you that there is no fixed date for this, but if you want, you can check the refund status yourself by visiting the Income Tax website. Let us know how to check the refund status.

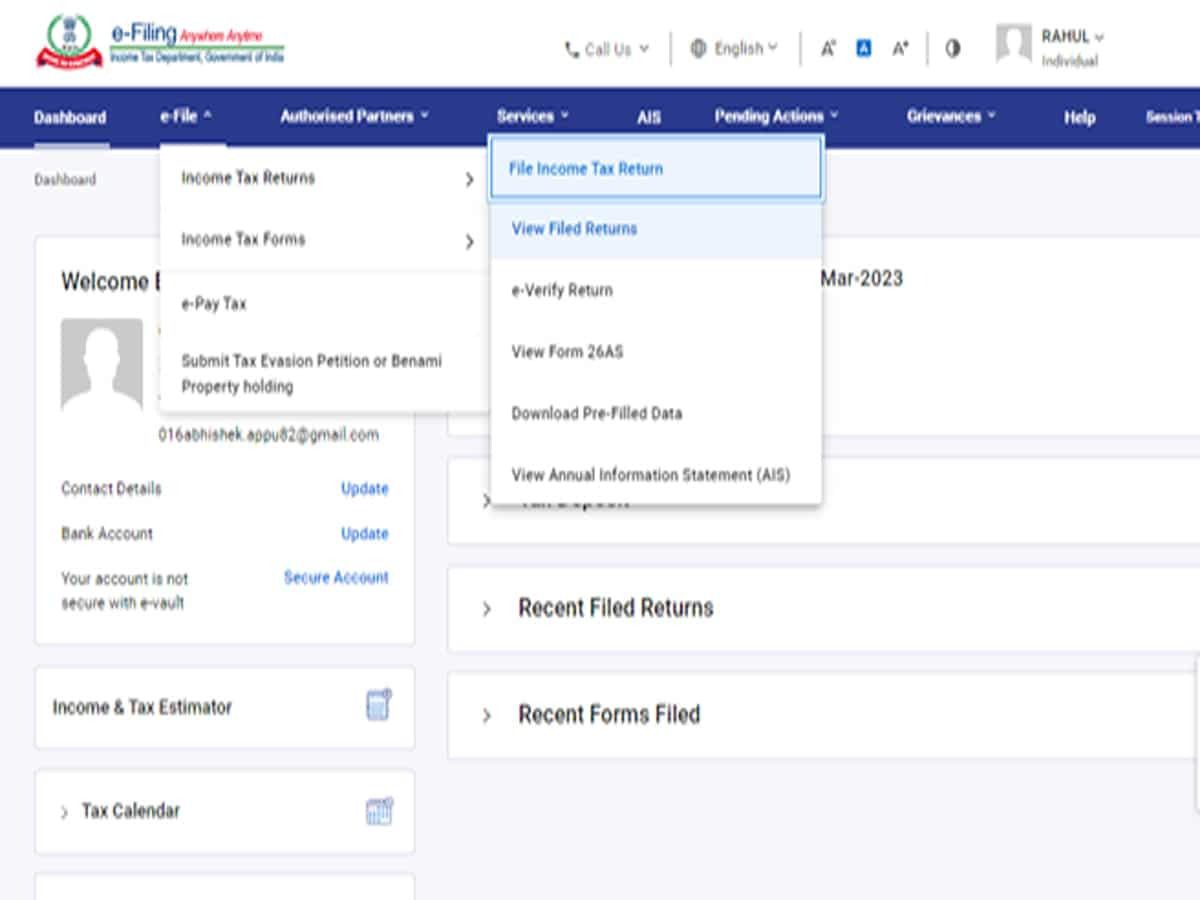

First go to the e-filing portal

If you want to know the status of your refund, first you have to go to the Income Tax e-filing portal.

Login with ID-password

You will have to login on the portal with your ID (PAN) and password. Here you will also have to enter a captcha code.

From there, go to your returns

In the next step, you will have to go to the e-File tab and click on View Filed Returns under Income Tax Returns.

Check refund status

There you have to click on View Details. Here you will also know the status of the refund and can also see the life cycle of ITR.

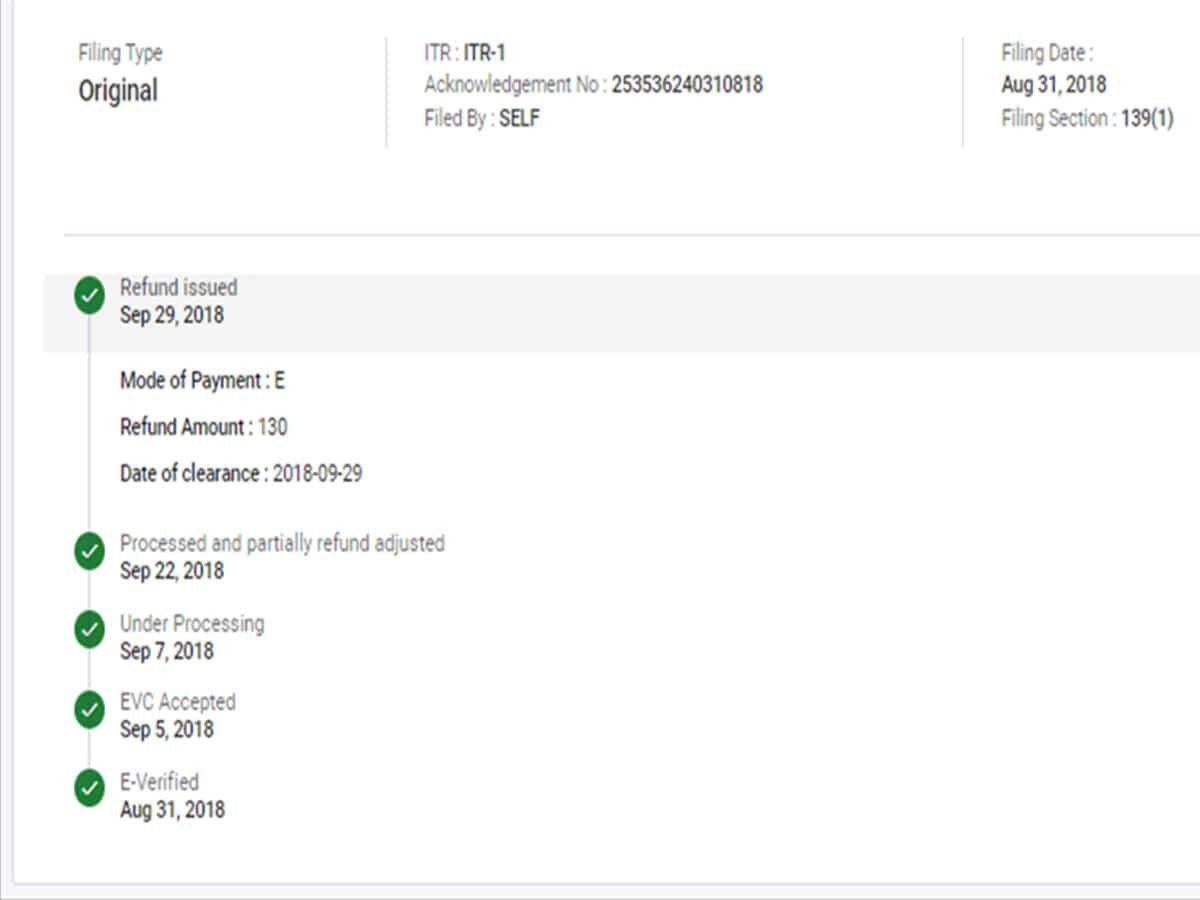

If the refund has been issued then…

If your refund has been issued, you will see a picture like the one above.

Refund partially adjusted…

If your refund has been partially adjusted, you will see a picture like this.

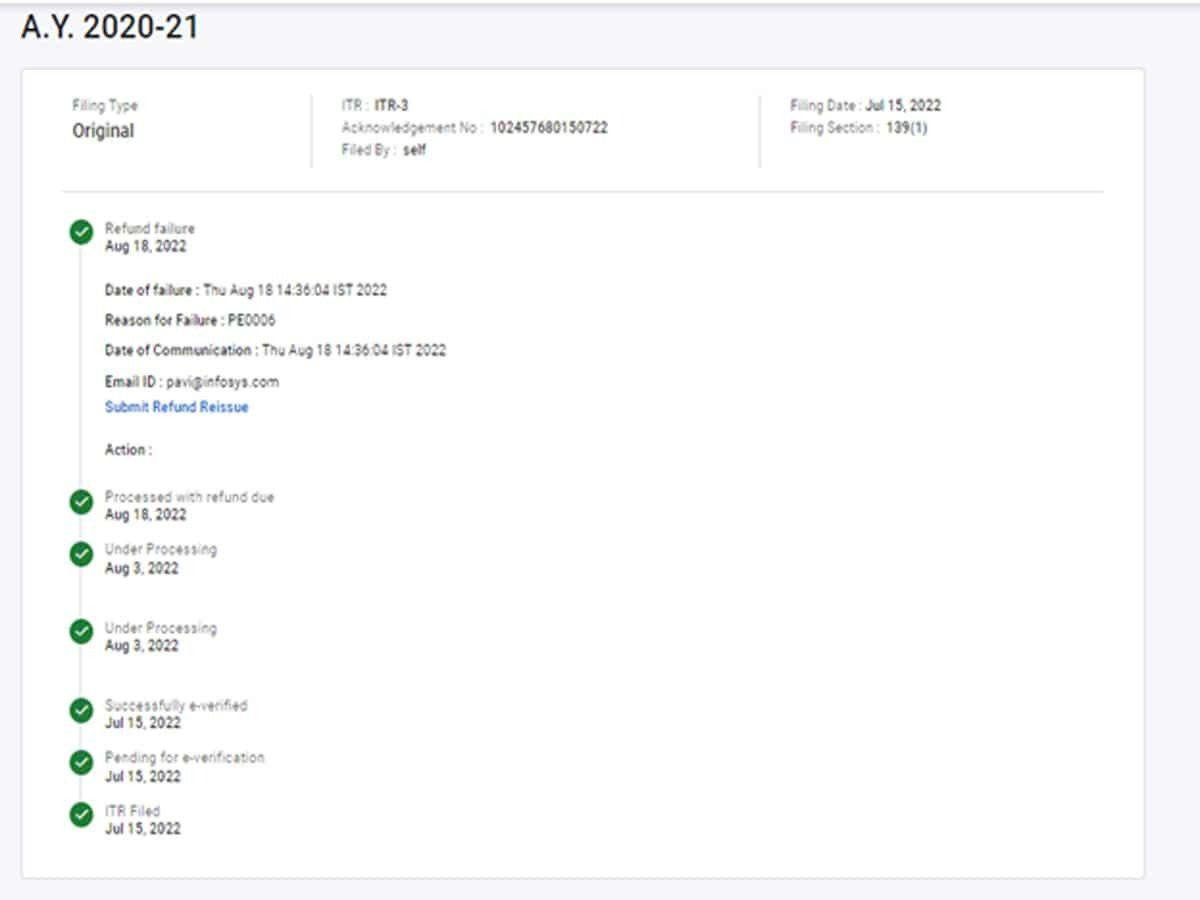

Full refund adjusted

If your entire refund has been adjusted, you will see a picture like this.

If the refund fails…

If your refund has failed then you will see something like this.

The post ITR Refund Status: Income Tax itself told how to check ITR Refund Status, here is the step-by-step process first appeared on informalnewz.

News