RBI action: Heavy fine imposed on these 4 banks, license of 10 companies cancelled

RBI has imposed fines on four banks. They are accused of ignoring the rules. The license of many non-banking finance companies has also been cancelled. Let us know whether this action will affect the customers and what is the reason behind it?

RBI action: Once again a big action of the Reserve Bank of India (RBI) has come to the fore. The central bank has imposed a heavy monetary penalty on four banks simultaneously. This list includes banks of Maharashtra and Karnataka. Apart from this, the certificate of registration i.e. license of 10 non-banking finance companies has been canceled. 7 companies themselves have surrendered their certificates for different reasons. Apart from this, an NBFC has also got relief, RBI has decided to restore the COR of Jupiter Management Service Private Limited (Gurgaon Haryana).

During an inspection conducted in March 2024, RBI came to know about the negligence in the rules. After which a show cause notice was issued to all the banks. After receiving the reply and further investigation, when the allegations were confirmed, then the decision to impose penalty was taken by the central bank. The list includes The Shahada People’s Co-operative Bank Limited (Maharashtra), Motiram Agarwal Jalna Merchants Co-operative Bank Limited (Maharashtra), Sahyadri Sahakari Bank Limited (Mumbai Maharashtra) and The Government Employees Co-operative Bank Limited (Dharwad, Karnataka).

Why did the banks face action?

The Shahada People’s Co-operative Bank Limited had regularized some non-performing accounts without repayment from the original source. For which RBI has imposed a monetary penalty of Rs 2 lakh on the bank.

Motiram Agarwal Jalna Merchant Co-operative Bank Limited approved loans related to directors. Apart from this, loans and advances were also given to some associated borrowers beyond the applicable group loan limit. A penalty of Rs 6 lakh has been imposed on this bank for violating these rules.

Sahyadri Sahakari Bank Limited did not reduce the single borrower loan limit for new loans and advances by 50% of the applicable regulatory limit, not following the instructions issued under SAAF. Therefore, a penalty of Rs 20,000 has been imposed on this bank.

The Government Employees Co-operative Bank Limited did not upload the KYC records of customers to the Central KYC Record Registry within the stipulated time. Apart from this, the bank also failed to implement the necessary measures related to cyber security control under the cyber security framework. Therefore, RBI has imposed a fine of Rs 1 lakh on the bank.

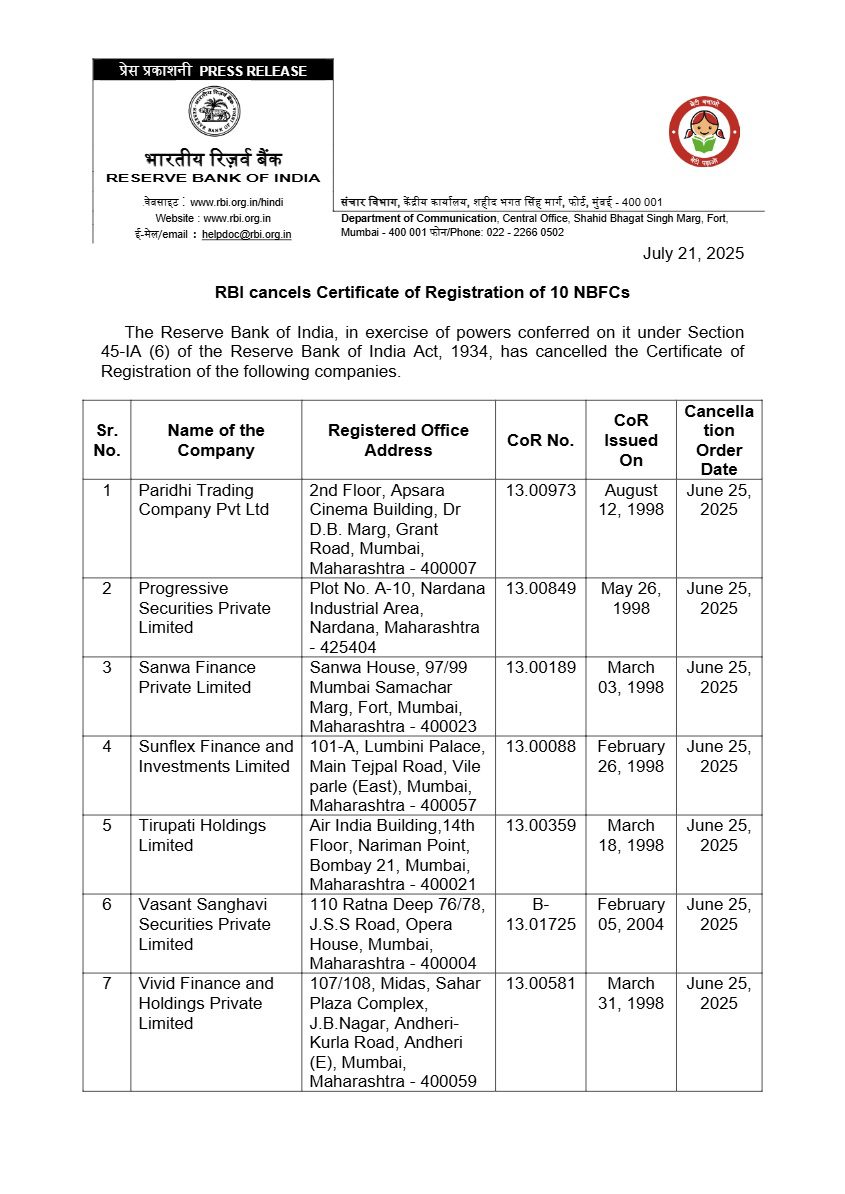

License of these companies cancelled

RBI has cancelled the certificate of registration of 10 non-banking finance companies of Maharashtra. All these companies are not allowed to do business from June 25. This list includes Paridhi Training Company Limited, Progressive Securities Private Limited, Finance Private Limited, Sunflex Finance and Investments Limited, Tirupati Holdings Limited, Vasant Sanghvi Security, Vividh Finance and Holdings Private Limited, Variety Investment Private Limited and Sriramanjeneya Investment Private Limited.

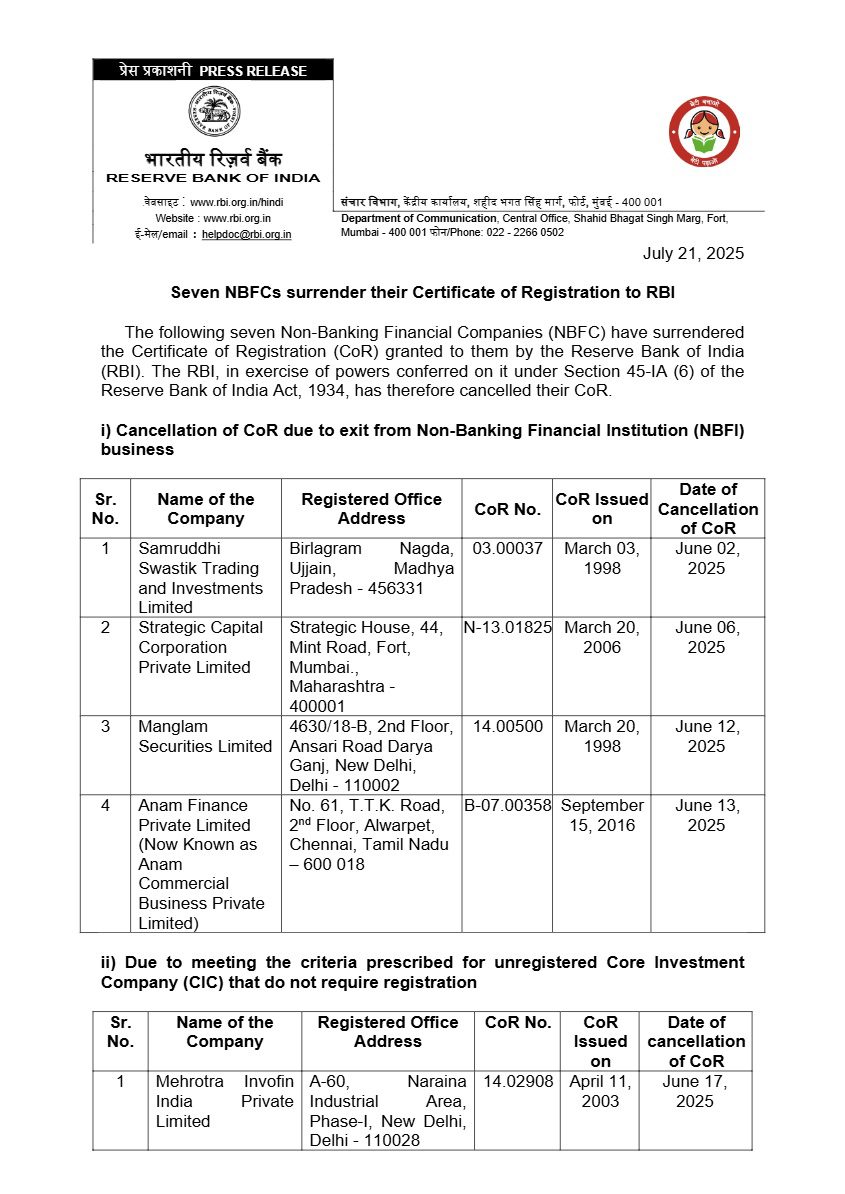

These companies surrendered CoR

Due to exiting the non-banking financial institution business, Samridhi Swastik Trading and Investments Limited, located in Madhya Pradesh, has surrendered its CoR. Strategic Capital Corporation Private Limited, located in Mumbai, Maharashtra, Mangalam Securities Limited, New Delhi and Anam Finance Private Limited, located in Chennai, Tamil Nadu, have also got their certificates of registration cancelled for the same reason.

Malhotra InfoOne India Private Limited does not require CoR as it fulfills the criteria prescribed for a registered investment company. Therefore, this company has surrendered its certificate. Welcome Investment Private Limited, located in Maharashtra and Tarish Investment and Trading Company Private Limited, Bangalore, have also surrendered their certificates due to reasons like amalgamation/dissolution/survey strike off.

News