All you need to know about Karnataka’s new SpaceTech Policy 2025-2030

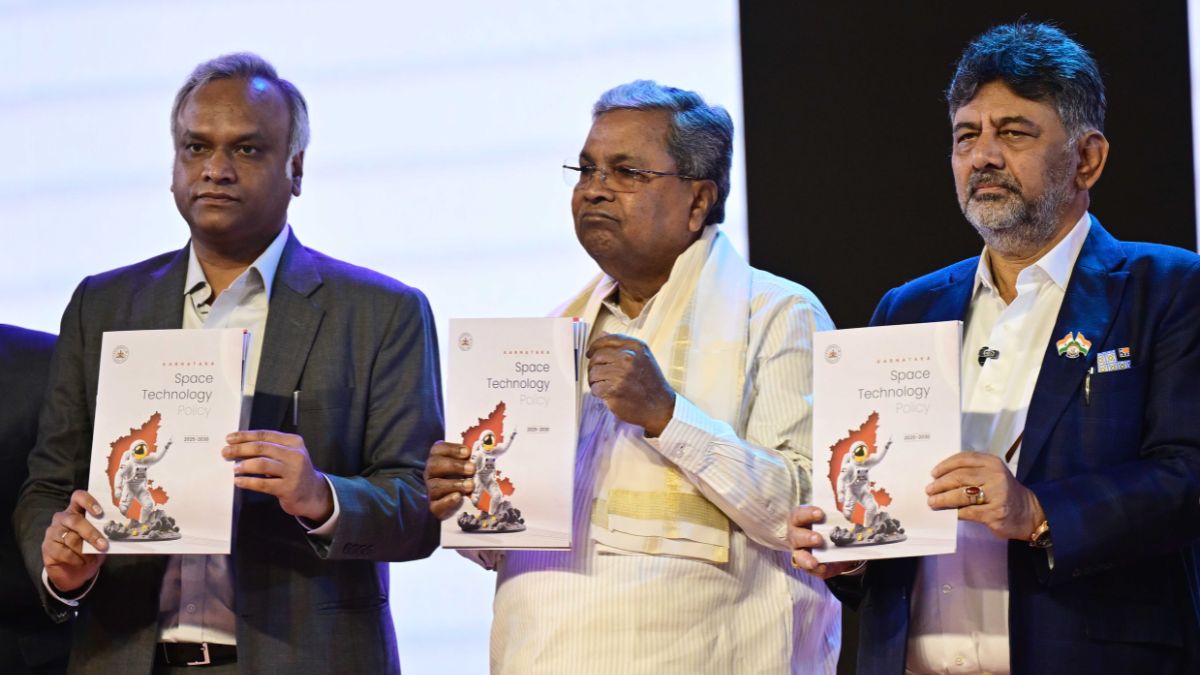

Karnataka CM Siddaramaiah (centre), Deputy CM D. K. Shivakumar (right), and IT minister Priyank Kharge (left) unveil the SpaceTech Policy 2025–2030 | Bhanu Prakash Chandra

Karnataka CM Siddaramaiah (centre), Deputy CM D. K. Shivakumar (right), and IT minister Priyank Kharge (left) unveil the SpaceTech Policy 2025–2030 | Bhanu Prakash Chandra

Karnataka has set its sights on the cosmos with the launch of its SpaceTech Policy 2025–2030, an ambitious roadmap that aims to capture 50 per cent of the national space market and 5 per cent of the global market by 2034.

These numbers are massive, but so is the opportunity. India’s space economy is expected to reach $44 billion by 2033, and every major state now wants a piece of that future. Karnataka believes it is best placed to lead the nation into the next era of space technology. But is that confidence justified, and will it be enough to take on the competition?

Karnataka undeniably starts from a strong position. The state is home to ISRO’s major facilities, over 16,000 startups, nearly half of India’s total startup funding, and a massive pool of tech talent. Bengaluru alone contributes 42 per cent of India’s software exports.

The new SpaceTech Policy focuses on specialised space-manufacturing parks, advanced testing facilities, and a Centre of Excellence for space technology. The government plans to train 50,000 students and young professionals for high-skill space jobs while targeting $3 billion in investments from global and domestic space companies. If executed well, Karnataka could position itself as the digital nerve centre of India’s space future.

Experts point out that Karnataka’s dominance is built on one of India’s most mature space ecosystems. The state is home to over 2,500 MSMEs serving as vendors to ISRO, the largest such supply chain in the country. Bengaluru alone hosts 32 spacetech companies with a combined funding of $323 million, and 15 defence tech companies that have secured another $123 million. New space startups headquartered in Bengaluru have collectively raised $150 million, representing 35 per cent of India’s total spacetech funding to date.

However, Karnataka is not alone in this race. Tamil Nadu, Telangana, and Gujarat have already crafted well-defined space policies, each grounded in their own natural strengths. Tamil Nadu enjoys a major geographical advantage as it is closest to ISRO’s Satish Dhawan Space Centre in Sriharikota, India’s primary rocket launch site. This proximity is something Karnataka can never match.

Tamil Nadu has also built a vibrant ecosystem around space startups like Agnikul Cosmos and GalaxEye. Its Space Industrial Policy aims to attract Rs 10,000 crore in investments and create 10,000 high-value jobs, positioning itself as a preferred destination for global manufacturers and high-tech hardware production.

Gujarat taps into its rich industrial base. Home to ISRO’s Space Applications Centre in Ahmedabad, Gujarat, has positioned itself as a precision manufacturing hub for aerospace and satellite components. The Gujarat SpaceTech Policy offers fiscal and non-fiscal incentives for companies working on launch vehicles, satellites, and advanced space hardware. Given Gujarat’s traditional strength in heavy industry, engineering, and manufacturing, its approach aligns perfectly with its capabilities.

Then there is Telangana—arguably the most aggressive early mover. Telangana was the first state to launch a dedicated SpaceTech Framework in 2022. It has a deep aerospace and defence ecosystem around Hyderabad, where SMEs contributed more than 30 per cent of components used in the ISRO Mars Orbiter Mission. Telangana’s policy encourages domestic production of launch vehicles, satellite subsystems, and ground equipment through strong public-private partnerships. Telangana’s head start means it already has frameworks, clusters, and partnerships in place—giving it a crucial advantage.

So where does Karnataka stand? “Karnataka’s biggest strength is not location or manufacturing, it is digital capability. Modern space missions are driven by software, AI, data analytics, navigation algorithms, communication systems, and cybersecurity. This is the future of the global space industry, and Karnataka sits right at the heart of this transformation. With 85 universities, 243 engineering colleges, and more than 400 R&D centres, Karnataka has the deepest talent pool in India. Bengaluru’s startup ecosystem and engineering expertise make it a natural leader for the software side of space technology—the ‘brain’ behind the rocket,” remarked space analyst Girish Linganna.

Karnataka’s ambitions

As this expert points out, ambition alone is not enough. Karnataka wants 50 per cent of India’s space market, but this requires beating Tamil Nadu’s proximity advantage, Gujarat’s hardware manufacturing supremacy, and Telangana’s strategic head start. It also requires flawless execution. Will the planned manufacturing parks actually be built? Will global companies invest billions? Will training programmes successfully convert into skilled jobs? Is the Rs 967 crore outlay enough to support such massive goals?

Karnataka’s SpaceTech Policy 2025–2030 stands as India’s most comprehensive and data-driven state-level framework for space industrialisation. “With the strongest vendor base, the highest density of spacetech startups, unparalleled institutional depth, and a mature funding ecosystem, Karnataka is uniquely positioned to become the powerhouse of India’s emerging $44 billion space economy. If successfully implemented, the policy could generate over 100,000 high-value jobs, anchor global manufacturing pipelines, attract billions in foreign and domestic investments, and firmly establish Karnataka as the centrepiece of India’s rise as a global space power,” said Srimathy Kesan, the founder and CEO of SpaceKidz India. As the state accelerates its integration of industrial, academic, and technological capabilities, the next decade will determine how effectively this bold vision transforms into sustained national leadership in the final frontier.

Execution will determine whether Karnataka becomes India’s SpaceTech capital or loses ground to its competitors. India’s space race is no longer just about ISRO; it is about states creating their own ecosystems, startups pushing innovation, and global companies choosing where to invest. “Karnataka has the vision, talent, and innovation power to lead India’s space future. But it must move swiftly, focus on its strengths, and deliver on its promises. The competition is real, and other states are racing hard. If Karnataka gets it right, it could truly become the command centre of India’s space economy. If it stumbles, others will seize the opportunity,” observed Linganna.

Experts point out that Karnataka’s dominance is built on one of India’s most mature space ecosystems. The state is home to over 2,500 MSMEs serving as vendors to ISRO, the largest such supply chain in the country. Bengaluru alone hosts 32 spacetech companies with a combined funding of $323 million, and 15 defence tech companies that have secured another $123 million. New space startups headquartered in Bengaluru have collectively raised $150 million, representing 35 per cent of India’s total spacetech funding to date.

The strategic importance of Karnataka’s policy extends well beyond economic projections. It supports India’s long-term goals of establishing the Bharatiya Antariksh Station by 2035, landing an Indian astronaut on the Moon by 2040, and conducting over 100 joint government–private satellite missions under the Viksit Bharat 2047 vision. The policy promotes the adoption of space technologies across state departments for disaster management, agriculture, urban governance, health, and remote diagnostics. Karnataka already utilises 52 remote-sensing datasets for governance and has deployment plans for 12 satellite-based alert systems across civic agencies.

“However, Karnataka must navigate key challenges, including talent shortages in specialised domains such as propulsion, avionics, space law, and AI-enabled satellite analytics—fields projected to see a 40 per cent rise in global demand by 2030. Building world-class testing infrastructure, such as thermal vacuum chambers and deep-space communication networks, requires substantial capital and collaboration with ISRO, IN-SPACe, and private operators. Timely disbursement of incentives, previously a bottleneck in state industrial policies, will significantly influence industry confidence and project execution timelines,” added Kesan.

Sci/Tech